Integrating Brownfields Redevelopment with Urban Redevelopment

Federal and state agencies provide economic incentives for the redevelopment of brownfields projects. The range of interests of the federal and state agencies providing incentives to potential redevelopers is as broad as the missions of the agencies. The 2017 Brownfield Federal Programs Guide, published by the USEPA, lists brownfields programs sponsored by numerous and diverse federal and multi-state entities in the United States. Each of these agencies seeks to address brownfields within the context of its mission. Some examples of agencies, their missions, and the programs they offer to support those missions are provided in Table 1.

TABLE 1

Examples of U.S. Agencies and Their Missions regarding Brownfields (source: U.S. Environmental Protection Agency, 2017 Brownfields Federal Programs Guide)

| Name of Agency | Mission Regarding Brownfields |

| U.S. Department of Agriculture | Revitalize rural communities |

| U.S. Department of Commerce | Encourage brownfields development |

| U.S. DOC – National Oceanic and Atmospheric Administration | Bolster the economic vitality of coastal communities |

| U.S. Department of Energy | Advance the national, economic, and energy security of the United States |

| U.S. Department of Health and Human Services | Address the economic and social services needs of the urban and rural poor at the local level |

| U.S. Department of Housing and Urban Development | Create strong, sustainable, inclusive communities and quality affordable homes |

| U.S. Department of the Interior – National Park Service | Preserve natural and cultural resources |

| U.S. Department of Labor | Advance opportunities for profitable employment |

| U.S. Department of Transportation – Federal Transit Administration | Provide financial and technical assistance to local public transit systems |

| National Endowment for the Arts | Encourage participation in the arts |

| U.S. Small Business Administration | Aid and protect the interests of small businesses |

| Appalachian Regional Commission | Strengthen economic growth in Appalachia |

Economic Incentives Under the Brownfields Act

In addition to avoidance of liability, federal and state brownfields programs offer a wide variety of economic incentives to prospective brownfields redevelopers. Some of these incentives are described below.

Brownfields Assessment Grants

Seed money for a redevelopment project often is needed during the feasibility phase of the development project. Federal programs such as the Community Block Grant Program administered by the U.S. Department of Housing and Urban Development (HUD) are designed to provide seed money to developers so that the project does not die before it can be born.

Low Interest or No Interest Loans

Many federal and state programs offer low interest or no interest loans to prospective brownfield redevelopers. The objective of the loan programs is to provide seed money upfront so that the planning and assessment portions of the project can begin and make the project economics more attractive. Typically, the loans come out of a revolving loan fund that must be paid back within a specified time period so that the same money can be loaned to the next qualifying brownfields project.

Tax Abatements and Tax Forgiveness

Certain states, counties, and municipalities have set up zones that are subject to lower taxes to spur development. Such zones may be known as “opportunity zones,” “urban enterprise zones,” or some similar designation. In addition, governmental agencies can offer lower or no taxes to specific redevelopment projects to enhance their economic viability. This often is done if the project is of sufficient size that by itself it is expected to spur economic revitalization of the surrounding area.

Tax Credits

Certain states, counties, and municipalities go beyond tax abatement and tax forgiveness by offering tax credits to brownfield developers. The amount of the tax credit typically is tied to the expected income stream from the redevelopment. Tax credits are particularly popular among developers that are not-for-profit, non-governmental organizations (NGOs). Since they don’t pay income taxes, they are allowed to sell these tax credits to non-governmental entities that are subject to taxation. This is a popular method of raising funds for NGOs involved in the construction of affordable and supportive housing and other such below market rate housing projects.

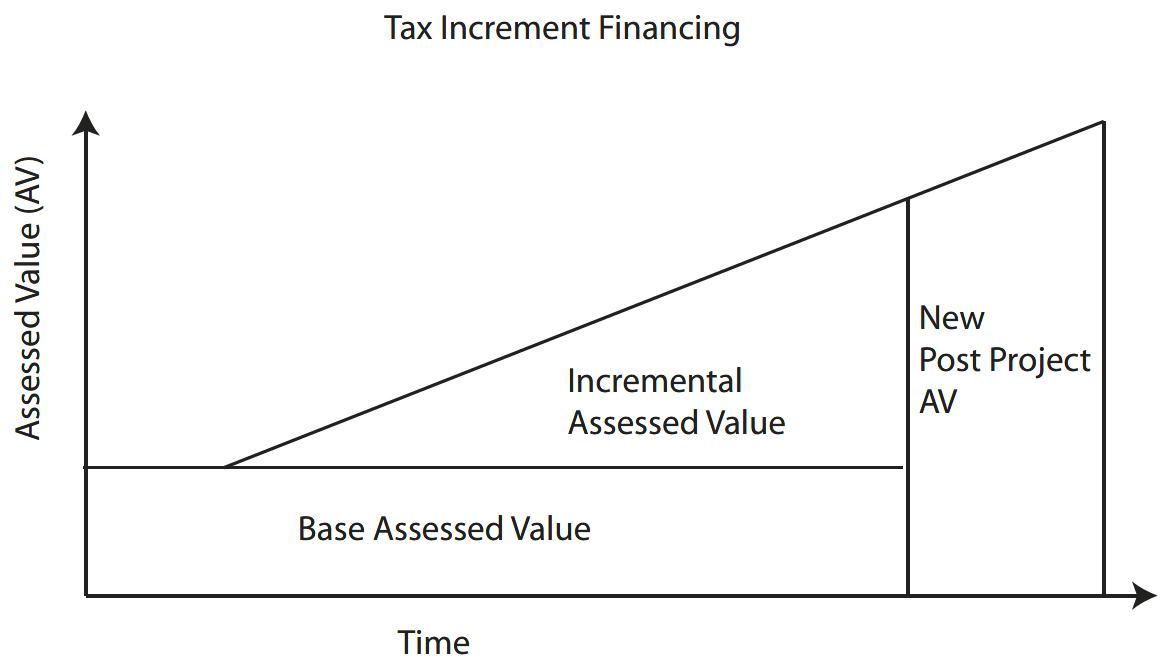

Tax Increment Financing

Tax increment financing (TIF) is a public financing method that is designed to spur new development, increase property values, and add to the tax base which, by doing so, will allow the investment to pay for itself, at least in theory. TIF typically is used on large, area-wide redevelopment projects.

For a brownfields redevelopment project, a public agency, a quasi-public agency, or a public-private partnership invests money towards brownfield cleanups in the designated area. Once completed, the project creates jobs and attracts other businesses which in turn create jobs. Figure 1 is a graph demonstrating how a TIF works. Property values rise and tax revenues increase from additional property taxes. Part of the tax revenues goes to the basic municipal services that were already being provided, such as schools, police, fire protection, water and sewer services, and so on. The other part of the tax revenue, which represents the “tax increment,” or additional taxes collected due to the rise in property values, is used to cover the initial outlay for the redevelopment. The money a city invests in TIF projects is often raised by issuing bonds whose interest is paid over the period of the bond.

Insurance Protection

Private insurance protection from liability is available. The costs for these protections may be partially defrayed by some state governments as an incentive for redevelopment.

FIGURE 1

Tax incremental financing

The next article in this series will discuss the numerous entities that play a role in a typical brownfields project with special emphasis on the role played by the environmental consultant.

The next article in this series will discuss the numerous entities that play a role in a typical brownfields project with special emphasis on the role played by the environmental consultant.

References

Good Jobs First, www.goodjobsfirst.org. Tracking Subsidies, Promoting Accountability in Economic Development.

Grand River Corridor web site, http://grandriver.fhgov.com/About/Funding.aspx.

Hersh, Barry, 2018. Urban Redevelopment – A North American Reader. Routledge, A Taylor & Francis Group.

U.S. Environmental Protection Agency, October 2011. Handbook of the Benefits, Costs, and Impacts of Land Reuse and Development. EPA-240-R-11-001.

U.S. Environmental Protection Agency, 2015. Unlocking Brownfields Redevelopment: Establishing a Local Revolving Loan Fund Program.

U.S. Environmental Protection Agency, 2017. 2017 Brownfields Federal Programs Guide.

Americas

Americas Europe

Europe Français

Français Deutsch

Deutsch Italiano

Italiano Español

Español Benjamin Alter

Benjamin Alter